When it comes to Medicare, you have two choices.

You can get your Medicare coverage through Original Medicare (Parts A, B and D) or Medicare Advantage (Part C). Understanding the differences between the two is the first, and most important, step in getting the coverage that is right for you.

Original Medicare is a health insurance program run by the federal government. Under that program, the government pays health care providers directly for the services you receive. Within Original Medicare, there are no network restrictions. You have the freedom to choose any doctor, specialist or hospital in the US when you need care, as long as they accept Medicare beneficiaries. When enrolled in Original Medicare, you do not need prior approval, a referral or permission from Medicare or from your primary care doctor when you need care.

You can also choose to supplement your Original Medicare coverage with…as the name would suggest…a Medicare Supplement, or Medigap coverage. You would have to pay an additional monthly premium for your supplement, but depending on the plan you choose, your out-of-pocket exposure for a given calendar year could be as low as $198 per year.

Original Medicare does not include vision or dental benefits, so you would have to obtain that coverage separately. You would also need to enroll in a standalone Prescription Drug Plan (Part D).

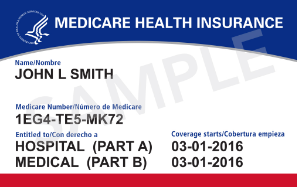

Medicare Advantage is a health insurance program run by private insurance companies contracted by Medicare. If you enroll in a Medicare Advantage plan you will automatically be disenrolled from Original Medicare and you will not use your red, white and blue Medicare card.

Medicare Advantage plans can include premiums as low as $0 per month, and many times include dental, vision and prescription drug coverage. That said, Advantage plans do include networks, and providers can move in and out of networks at any time. In most cases, you will also need to get prior approval when you need care, except in case of an emergency.

The out-of-pocket exposure when enrolled in a Medicare Advantage plan can be as high as $6,700 for in-network coverage and $10,000 for out-of-network coverage.

So what should I do?

In some ways, it’s a trick question, as there is no one answer.

Medicare Advantage plans can cost less and include additional benefits, but your risk of incurring a large expense can be greater and you are bound to a network. Original Medicare, coupled with a supplement, costs more, but can greatly reduce the amount of money you would have to pay should you experience a significant health issue and allows you more freedom to choose your provider.

We are happy to help you talk through all of your options. In the end, our goal is to provide you with the comfort of knowing you are well prepared for a healthy and cost-effective future.